- First EIB partnership with Norsad Capital to help local companies overcome COVID challenges

- First credit line in Botswana under EIB’s Africa COVID response

The European Investment Bank (EIB) has agreed to provide support to the value of EUR10 million in new long-term financing for entrepreneurs and businesses across Botswana with a leading local partner Norsad Capital. This represents the first targeted EIB support for private-sector financing to help Botswana companies impacted by COVID-19 and is part of the EIB’s engagement with financial partners across Africa to strengthen economic resilience to the pandemic.

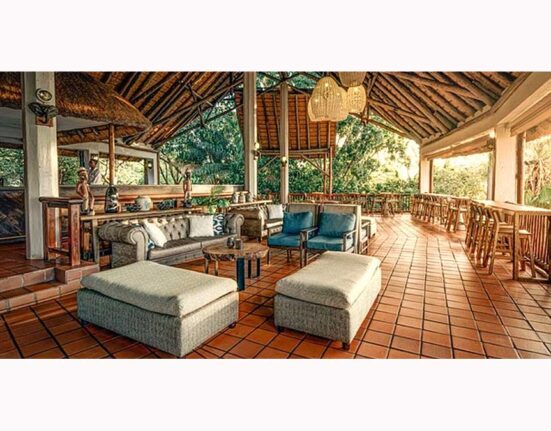

The new partnership between the EIB, the world’s largest international public bank, and Norsad Capital, an impact investor and leading private debt company in Africa, will increase access to long-term finance for businesses across Botswana and strengthen economic resilience to challenges of the COVID-19 pandemic. This builds on close cooperation in recent years to support private sector investment across the country.

The new business financing will support investment in manufacturing, agriculture, services and trading companies across the country.

The new EIB–Norsad Capital cooperation to support business investment in Botswana was formally announced in Gaborone by Kenny Nwosu, CEO of Norsad Capital, and Jim Hodges, EIB regional representative to Southern Africa.

“Companies across Botswana have been impacted by health, trade and business challenges triggered by the COVID-19 pandemic. Norsad Capital will target qualifying private-sector investments across the country seeking to create economic opportunities. The EUR10 million European Investment Bank backing for companies across Botswana will unlock new private-sector financing, that will have a positive impact on livelihoods. The close cooperation between the Norsad Capital and EIB teams over recent months has unlocked access to longer-term loans that are essential for businesses to grow during challenging times and ensures that Botswana benefits from the EIB’s engagement to strengthen economic resilience to COVID across Africa,” said Nwosu.

“Increasing access to finance by entrepreneurs and businesses is essential to address business uncertainties and overcome economic challenges exacerbated by COVID-19. Today’s new agreement demonstrates how European Union and African partners together are helping to beat COVID and ensure that private sector business can invest, create jobs and grow. As part of Team Europe, the European Investment Bank is pleased to provide EUR10 million of new targeted financing to Norsad Capital to unlock new private-sector financing essential to strengthen private-sector investment, create jobs and accelerate the post-pandemic recovery of Botswana,” said Thomas Östros, Vice President of the EIB.

“The European Union is committed to supporting the private sector in Africa. The Team Europe cooperation with the European Investment Bank will increase access to targeted business finance by companies across Botswana. Helping private sector resilience with the new EUR10 million financing scheme will create jobs, unlock business growth and enable Botswana companies to seize new business opportunities in the years ahead,” said Ambassador Jan Sadek, Head of the Delegation of the European Union to Botswana.

Supporting investment in businesses across Botswana during challenging times

The 10-year EUR10 million EIB loan to Norsad Capital will allow new financing to be provided to private businesses, notably small and medium-sized enterprises, across Botswana.

The new financing will allow longer average loan tenors for business loans and enable companies to better reflect the economic life of new investment.

Ensuring that Botswana benefits from rapid EIB response to strengthen economic resilience to COVID

The new EIB–Norsad Capital cooperation represents the EIB’s first support for business investment in Botswana in eight years.

The scheme is part of the EIB’s increased engagement across Africa to ensure that companies can continue to access finance when faced with unprecedented health, business and trade challenges linked to COVID-19. The investment was approved by European Union finance ministers in April 2020, within weeks of the impact of the pandemic being recognised.

The EIB is the world’s largest international public bank, owned directly by the 27 European Union member states.

Since the pandemic, the EIB has provided more than EUR8 billion for private and public investment across Africa.