Banco Letshego S.A. (“Letshego Mozambique” / “Banco Letshego”), the well-established inclusive finance provider leveraging digitalisation to enable more Mozambicans to access productive financial solutions, is now diversifying its funding sources with an inaugural debt listing on the Mozambique Stock Exchange. The bond was listed at a value of MZN1.3 billion (circa USD21 million) with proceeds supporting Banco Letshego’s growth strategy, that includes extending access to inclusive financial solutions for more Mozambicans, as well as increasing product choice and enhancing customer delivery.

Commenting on the transaction, Country CEO Carlos Nhamahango said, “Letshego is passionate and committed to increasing its investment and reach in Mozambique. With a debt listing on our national stock exchange we can reiterate our confidence in Mozambique’s developing capital market, while diversifying our funding source to support our ongoing delivery to stakeholders, including customers, our people, investors and our local communities.”

With the inaugural debt raising being valued at MZN1.3 billion (circa USD21million), Banco Letshego’s bond constitutes the largest corporate raising event in the history of Mozambique’s Bond Market. Structured as senior unsecured notes, the bond secured strong interest with 2.6 times oversubscription. The landmark issuance was executed in two tranches, with secured investment appetite from a range of investors including local institutional funds, retail investors and an international investor. The second of the two debut tranches closed successfully on 25 August 2023.

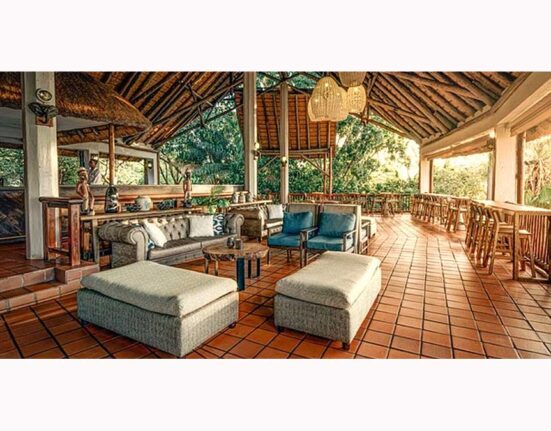

From the Group’s regional head quarters in Botswana, Letshego’s Group Chief Executive, Aupa Monyatsi added, “Letshego is proudly pan-African and has been improving the lives of customers and communities for 25 years. Our brand strategy aims to achieve a multidimensional impact, prioritising sustainable commercial, environmental and social returns. In listing local bonds, our subsidiaries can gain access to local capital, in local currencies, all while supporting the development of local capital markets across our Africa footprint.”

Partners supporting the execution and listing of Letshego Mozambique’s bond includes Standard Bank acting as the Sole Lead Arranger, and Couto, Graca & Associados (CGA) serving as the official legal advisors for the transaction.