French development finance institution, Proparco has provided a senior loan facility to Letshego Botswana (“Letshego Financial Services Botswana”) to the value of 15 million Euros. This funding partnership enables Letshego Botswana to extend the value of its inclusive finance strategy, increasing access and deepening the impact of its financial solutions to more Batswana, wherever they may be located.

Proparco is a development finance institution owned by the French Development Agency and private shareholders from across the globe. Proparco’s ambition is to promote strategic private investment in Africa, Asia, Latin America and the Middle East that enables companies and institutions to support the United Nation’s Sustainable Development Goals.

Proparco’s 15 million Euros senior loan supports Letshego Botswana’s quest to improve more lives with inclusive finance products across Botswana. By encouraging customers to use their loans for productive purposes, which includes using funds for affordable housing, small business development and micro agriculture-related activities, Letshego’s loans support sustainable social and community development.

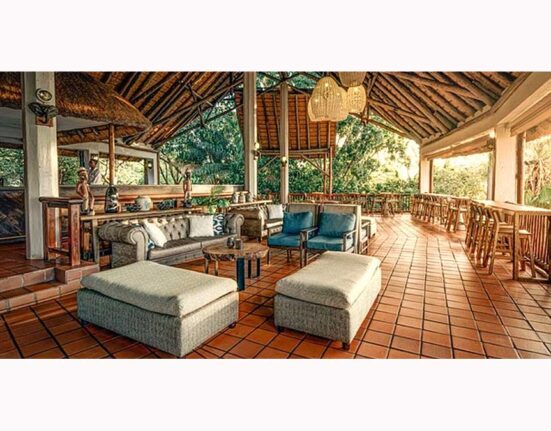

The finalisation of the transaction was marked at a ceremony held in Gaborone on the 26th of November, in the presence of the French Ambassador to Botswana.

Kgotso Bannalolhe, Chief Executive of Letshego Botswana, and Regional Executive for Eswatini and Lesotho remarked, “We are pleased to have Proparco on board as a strategic partner and funder, contributing to the expansion of our vision for Botswana. As a development funder, Proparco shares the same principles in achieving a positive economic and social impact through sustainable business practices. We look forward to working together to deepen our reach to more Batswana.”

In addition to funding, Proparco also provides additional support via ‘Technical Assistance’ – dedicated specialist expertise that brings strategic benefit to Proparco’s clients. Through Proparco’s Technical Assistance, Letshego Botswana will secure its certification in ‘Client Protection Principles’ in addition to other social development ratings. This global certification assures Letshego’s commitment to following global governance standards as well as sustainable, customer centric practices in lending and financial products.

Letshego’s Proparco facility also qualifies as part of the ‘Bottom 40’ and meets 100% of the 2X Challenge (“two by challenge”) criteria. These two globally recognised social indicators demonstrates Letshego Botswana commitment to generating socio-economic value and its commitment to gender equality principles and policies across its leadership, strategy and employment guidelines.

Steven Gardon, Regional Director for Southern Africa at Proparco expressed his enthusiasm for this initiative, “We are proud to finance Letshego Botswana and empower this microfinance institution to enhance its impact. Reducing social inequalities is at the core of Proparco’s 2023–2027 strategy.”

This funding partnership focuses on 2 of the 3 key priorities for Proparco’s 2023-27 strategy “Acting together for greater impact”, acting for “a more sustainable and resilient economy” through the impact of the MSEs product, and acting for “greater equality” through the microfinance activities and the affordable housing product.

The three Sustainable Development Goals (UN SDG’s) that funding facility supports are: SDG 1 – No Poverty ; SDG 5 – Gender equality and Women’s empowerment and SDG 8 – Decent Work and Economic Growth.