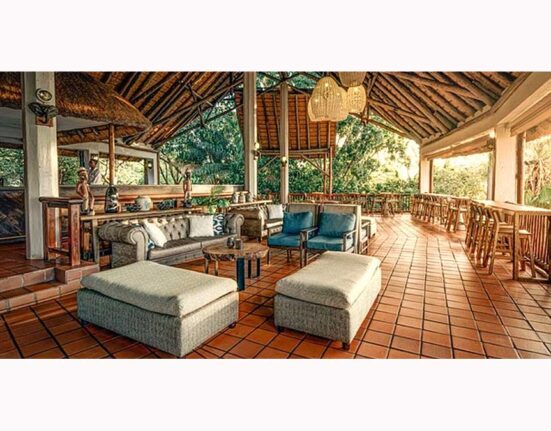

This morning, Thursday, we had the pleasure of joining First National Bank of Botswana (FNBB) Limited where the bank delivered its full Year Financial Results for the year ended 30 June 2022 at the Grand Aria Hotel in Gaborone.

FNBB Director of Marketing and Communications, Peo Porogo welcomed those in attendance before ushering in Gomolemo Basele, FNBB Economist, who provided an economic outlook, highlighting the impact of geopolitical tensions, other global events, and inflationary pressures on Botswana’s economic recovery agenda.

“The primary challenge remains the geopolitical tensions which have resulted in the increase in food and fuel prices, however, we expect a new copper mine to come in next year which is supposed to aid in diversifying our economy, to name just one of the interventions we’re expecting to provide relief to our market,” said Basele.

For his part, FNBB Chief Executive Officer (CEO), Steven Lefentse Bogatsu highlighted the need to offer more digitally led solutions to their customers in line with the global challenges. Bogatsu emphasized that with the digital advances that the bank has invested in, a customer almost never needs to physically go into a branch.

Meanwhile, FNBB Chief Financial Officer Luke Woodford, added: “We previously had 169 ATMs across the country, which has since been reduced and replaced with Automatic Transfer of Funds (ADTs) that allow deposits. Our footprint has doubled over the past year, as over 100 locations that previously didn’t have access to financial services can now do so through CashPlus Agents. We have over 649 CashPlus Agents country-wide and we encourage customers to take advantage of these advancements for easier access and convenience.”