The Botswana insurance industry celebrated a significant milestone with the successful inaugural edition of the inaugural Botswana Life Insurance Symposium. Held on the 20th of September 2023 in Gaborone, this landmark event brought together industry experts, thought leaders, and stakeholders to delve into the critical theme of “Understanding and Addressing the Insurance Protection Gap (IPG),” doing so with great success in shaping insightful dialogue on the subject.The Symposium saw the subject dissected from both an operational and needs perspective, interrogating the depth of the IPG and the necessary measures, resources and infrastructure that may be required to close this gap for the socio-economic benefit of the nation and her people. This is in alignment with Botswana’s Vision 2036 financial objectives, which focus on enhancing financial inclusion and security for all Batswana. The subject was tackled with a myriad of angles and approaches under the below:

- Keynote address delivered by NBFIRA CEO, Oduetse Motshidisi

- Panel 1 led by BIHL COO, Johannes Van Schalkwyk, explored the topic; Understanding and Addressing the Insurance Protection Gap (IPG), with panelists; Valentine Ojumah representing Sanlam Nigeria, Fritzgerald Dube, General Manager from Fudicia Advisory and Maxwell Mokoka from Marsh Botswana.

- Panel 2 led by Botswana Life Affluent Segments Specialist Manager, Thabiso Nkile, dissected the topic, protecting your inheritance through estate management with panelists Ame Masuku representing Modisane Correia, Refilwe Mogwe from Botswana Life and Thapelo Borekilwe from Kingsway.

- Panel 3 led by BIHL Group Chief Actuary, Frank Dalo cascaded the topic; empowering your future, navigating shifting demographics with comprehensive wellness, health insurance and life insurance strategies and with panelists;

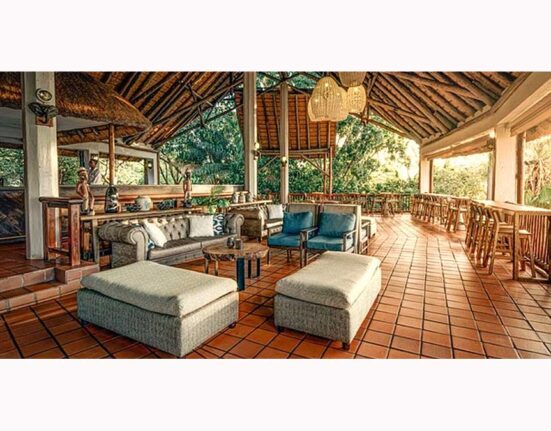

Said Botswana Life CEO, Ronald Samuels, “This inaugural Insurance Symposium exemplifies our ongoing efforts to bridge the insurance protection gap by empowering our customers with the necessary financial literacy. It is not just about us as one business, but about all in the ecosystem in Botswana and indeed beyond, all working together to inculcate sustainable progress. We are grateful for all our speakers, guests and indeed stakeholders, for we have much great thinking and actions to now follow through with, and we look forward to building and acting on these so that we see measurable progress before next year’s Symposium. It begins with us, and our commitment is without falter.”

The Insurance Protection Gap, the disparity between the coverage provided by existing insurance policies and the actual financial needs of individuals and families in the event of unexpected life events (illness, accidents, or death) remains a core concern in the local market. The Symposium successfully shed light on the various facets of the gap, explored its implications on individuals and society, and discussed strategies to bridge it effectively as a community and industry collective.

Speaking as part of the occasion, Non-Bank Financial Institutions Regulatory Authority (NBFIRA) CEO, Oduetse Andrew Motshidisi, said, “The main drivers of, and interventions on insurance protection gap differ across jurisdictions depending on the level of their respective economic development. Moreover, different methodologies applied to measure the gap across countries, present challenges to compare the gap and build appropriate interventions. However, individual countries should tailor-make interventions to their respective market environments.Evidence suggests that insurance protection gap can come from both demand and supply sides. From the demand side, in frontier and emerging markets, the gap is primarily caused by issues of insurance affordability and awareness, while in mature markets the gap is explained by products appeal. Moreover, in frontier markets, the issues of trust and culture contribute to the gap more than in emerging and mature markets. Interestingly, the element of behavioral biases is found in all economies. On the supply side, transaction costs and the level of institutional developments are the root causes of the gap in frontier and emerging markets. Adverse selection, moral hazard, and limits to insurability account for the gap in mature and emerging markets.”